How does VA handle the deficiency in a short sale?

VA has their own own short sale process, called the VA Compromise Sale. While VA follows the same basic steps of any short sale, the deficiency (loss to the lender from the short sale), is handled differently from all other loans. In VA short sales, this loss is not forgiven, or pursued. It simply reduces the amount of the VA entitlement. This article, by author Shane Milne - Mortgage Loan Officer, gives a detailed of explanation of how this works.

VA Entitlement After Foreclosure Or Short Sale: What Happens To Your Benefit?

Life happens. Job loss, divorce, medical emergencies, PCS to a location where you can't sell — sometimes veterans lose their homes through foreclosure, short sale, or deed-in-lieu of foreclosure. It's devastating, and one of the first questions I hear is:

"Did I lose my VA loan benefit forever?"

The answer is almost always no. But the situation is complicated. Your entitlement may be partially "charged," you'll face waiting periods, and there are hoops to jump through before you can use VA financing again.

This post explains exactly what happens to your entitlement after a foreclosure or short sale, how to calculate your remaining purchasing power, and how to restore what was lost.

What Happens When a VA Loan Ends in Foreclosure?

When a VA-guaranteed loan goes into foreclosure and the property is sold, the VA may have to pay a claim to the lender. This happens when the sale price doesn't cover the outstanding loan balance.

Example:

| Item | Amount |

|---|---|

| Outstanding VA loan balance | $350,000 |

| Property sold at foreclosure auction | $280,000 |

| Deficiency (loss) | $70,000 |

| VA pays claim to lender (up to 25% guaranty) | $70,000 |

When the VA pays this claim, the loss amount is "charged" against your entitlement. This is the key concept to understand.

What Does "Charged" Entitlement Mean?

When entitlement is "charged," that dollar amount is subtracted from your available entitlement until you either:

Repay the VA's loss, OR

Use your remaining entitlement (if sufficient)

Your entitlement is NOT gone forever. It's reduced by the amount the VA lost.

Using the example above:

| Entitlement Status | Amount |

|---|---|

| Original maximum entitlement (standard county) | $208,187 |

| Amount charged due to foreclosure | $70,000 |

| Remaining entitlement | $138,187 |

| Maximum zero-down purchase with remaining | $552,748 |

You can still get another VA loan — you just have less entitlement to work with.

Short Sale and Deed-in-Lieu: Same Rules Apply

Short sale: You sell the home for less than you owe, with the lender's approval. If there's a deficiency the VA covers, entitlement is charged.

Deed-in-lieu of foreclosure: You voluntarily transfer the property deed to the lender instead of going through foreclosure. If there's a loss, entitlement is charged.

The entitlement impact is the same regardless of whether you went through formal foreclosure, short sale, or deed-in-lieu. What matters is whether the VA paid a claim and how much.

Owe More Than Your Florida Home Is Worth?

Fill out this quick form to see if a VA short sale can help you move on - free, confidential, and stress-free. We’ll guide you step by step!

Free. Confidential. No out of pocket costs. Your info is always 100% private & secure.

Calculating Your Remaining Entitlement

After a foreclosure or short sale, you need to know two things:

How much entitlement was charged (the VA's loss)

Your county's loan limit (for calculating remaining purchasing power)

The Formula

Step 1: Determine max entitlement for your county

County Loan Limit × 25% = Max Entitlement

Step 2: Subtract the charged amount

Max Entitlement − Charged Amount = Remaining Entitlement

Step 3: Calculate max zero-down purchase

Remaining Entitlement × 4 = Max Zero-Down Purchase

Step 4: If buying above that amount, calculate down payment

(Purchase Price − Max Zero-Down) × 25% = Down Payment Required

Worked Example

Situation: Veteran had $50,000 charged after a foreclosure. Now wants to buy a $400,000 home in a standard county ($832,750 limit).

| Step | Calculation | Result |

|---|---|---|

| Max entitlement | $832,750 × 25% | $208,187 |

| Charged amount | — | $50,000 |

| Remaining entitlement | $208,187 − $50,000 | $158,187 |

| Max zero-down | $158,187 × 4 | $632,748 |

| Purchase price | — | $400,000 |

| Down payment required | — | $0 |

Result: Even with $50,000 charged, the veteran can purchase a $400,000 home with zero down.

Example Requiring Down Payment

Situation: Same veteran, but wants to buy a $700,000 home.

| Step | Calculation | Result |

|---|---|---|

| Max zero-down | — | $632,748 |

| Purchase price | — | $700,000 |

| Overage | $700,000 − $632,748 | $67,252 |

| Down payment required | $67,252 × 25% | $16,813 |

Result: Veteran needs $16,813 down (about 2.4%) — still far less than conventional would require.

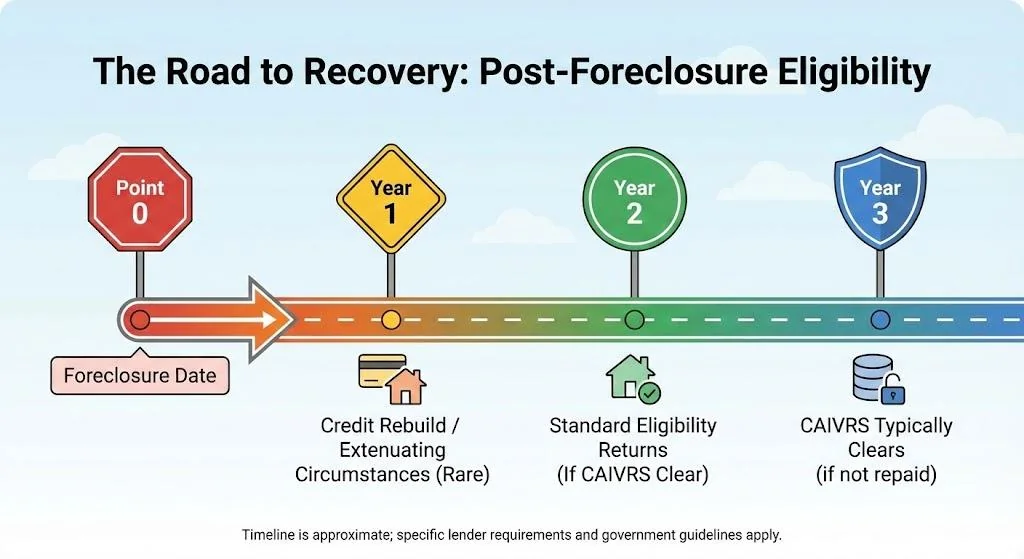

The Waiting Period

Even if you have remaining entitlement, you can't immediately get another VA loan after foreclosure. There are waiting periods.

Standard Waiting Period: 2 Years

The general rule is 2 years from the date of the foreclosure sale or transfer of title (for short sale/deed-in-lieu).

After 2 years, if you have remaining entitlement and meet all other VA loan requirements, you can obtain a new VA loan.

Reduced Waiting Period: 1-2 Years

You may qualify for a shorter waiting period (as little as 12 months) if you can demonstrate:

- The event was caused by circumstances beyond your control — job loss, medical emergency, divorce, military relocation, etc.

- You have re-established satisfactory credit — on-time payments on other accounts, new positive credit history

- Your current financial situation is stable — steady income, reasonable DTI

Lenders have discretion here. You'll need to write a letter of explanation documenting what happened and why it won't happen again.

Potentially No Waiting Period (Rare)

In some cases, there may be no mandatory waiting period if:

- Your payment history was not negatively affected before the short sale/deed-in-lieu

- You voluntarily and proactively communicated with the servicer

- The event was clearly due to circumstances beyond your control

This is uncommon and requires strong documentation. Most veterans should expect at least a 12-month wait.

Bankruptcy + Foreclosure Timing

If you went through both bankruptcy AND foreclosure, the waiting period is calculated from the later of:

- Bankruptcy discharge date, OR

- Foreclosure sale/transfer date

You don't "stack" waiting periods — use whichever date is more recent.

CAIVRS: The Federal Database That Can Stop You

CAIVRS (Credit Alert Verification Reporting System) is a federal database that tracks defaults on government-backed loans, including VA, FHA, USDA, and federal student loans.

If you have a CAIVRS hit, you cannot get a new VA loan until it's resolved.

What Creates a CAIVRS Hit?

- VA loan foreclosure, short sale, or deed-in-lieu where VA paid a claim

- FHA loan default

- USDA loan default

- Federal student loan default

- SBA loan default

- Any other defaulted federal debt

How Long Does a CAIVRS Hit Last?

For VA loans, the CAIVRS hit typically remains until:

- You repay the VA's loss in full, OR

- Three years have passed since the claim was paid (this can vary)

Important: Even if you have remaining entitlement and the 2-year waiting period has passed, a CAIVRS hit will prevent loan approval.

Clearing a CAIVRS Hit

Option 1: Repay the VA's loss

Pay back the full amount the VA lost. Contact the VA Debt Management Center at 1-800-827-0648 to arrange repayment.

Option 2: Wait for CAIVRS clearance

After a certain period (typically 3 years from claim payment), the CAIVRS flag may be removed. However, this timing isn't guaranteed — some hits persist longer.

Option 3: Dispute errors

If you believe the CAIVRS hit is in error, you can dispute it through the VA.

Federal Student Loans and CAIVRS

This catches many veterans off guard. Defaulted federal student loans create CAIVRS hits that prevent VA loan approval — even if your prior VA loan was paid off perfectly.

If you have student loan issues, resolve them before applying for a VA loan. Options include:

- Rehabilitation (9 on-time payments)

- Consolidation

- Income-driven repayment plans

Note: The Fresh Start Program enrollment window ended October 2, 2024. Veterans still in student loan default must now use standard rehabilitation or consolidation.

Restoring Charged Entitlement

If entitlement was charged due to foreclosure/short sale, you have two paths:

Path 1: Use Remaining Entitlement (Don't Restore)

If your remaining entitlement is sufficient for your purchase goals, you don't need to restore anything. Just use what you have.

When this makes sense:

- Charged amount is relatively small

- You're buying in a lower-cost area

- You can make a small down payment if needed

Path 2: Repay VA's Loss (Full Restoration)

Pay back the full amount the VA lost, and your charged entitlement is restored.

How to repay:

- Contact VA Debt Management Center: 1-800-827-0648

- Obtain the exact payoff amount

- Arrange payment (lump sum or payment plan may be available)

- Once paid, request updated COE showing restored entitlement

When this makes sense:

- You need full entitlement for a larger purchase

- You want to eliminate any down payment requirement

- You have the cash available

- You want to clear your CAIVRS record

Cost-benefit analysis:

| Scenario | Charged Amount | Repay? | Rationale |

|---|---|---|---|

| $30,000 charged, buying $350,000 home | $30,000 | Probably not | Remaining entitlement covers purchase with $0 down |

| $80,000 charged, buying $700,000 home | $80,000 | Maybe | Would need ~$29k down without restoration; compare to $80k repayment |

| $50,000 charged, buying $900,000 home | $50,000 | Yes | Restoration makes significant difference at this price point |

Can You Use VA Again If You Still Owe the VA Money?

Yes, but with limitations.

Having a debt to the VA doesn't automatically disqualify you from getting another VA loan. However:

- CAIVRS must be clear — if the debt created a CAIVRS hit, you need to resolve it

- You must have remaining entitlement — or make a down payment

- Lender may have overlays — some lenders won't approve borrowers with outstanding VA debts

In practice, if you owe the VA money from a foreclosure, you'll likely need to either repay it or wait for CAIVRS clearance before getting another VA loan.

One-Time Restoration Does NOT Apply Here

If you've read about the one-time restoration of entitlement, that applies to a different situation — when you pay off a VA loan but keep the property.

One-time restoration cannot be used to restore entitlement charged due to foreclosure, short sale, or deed-in-lieu.

The only way to restore entitlement lost to a VA claim is to repay the VA's loss.

For more on one-time restoration and how it differs, see: Using Your VA Loan Benefit More Than Once — Entitlement Restoration

Impact on Funding Fee

After a foreclosure or short sale, when you get your next VA loan, it will be considered subsequent use — meaning higher funding fees at 0% down.

| Down Payment | First Use | Subsequent Use |

|---|---|---|

| Less than 5% | 2.15% | 3.30% |

| 5% to <10% | 1.50% | 1.50% |

| 10%+ | 1.25% | 1.25% |

Strategy: If you're putting any down payment anyway (due to reduced entitlement), try to hit 5% — it drops the funding fee from 3.30% to 1.50%.

Exemptions still apply: If you have a VA disability rating, you pay no funding fee regardless of prior foreclosure.

What Shows on Your COE?

After a foreclosure or short sale where VA paid a claim, your Certificate of Eligibility will show:

- Prior loan information: The foreclosed property, loan amount, date, and status ("Foreclosed" or similar)

- Entitlement charged: The dollar amount subtracted from your entitlement

- Remaining entitlement: What you have available

Your COE will NOT show:

- "You can never get a VA loan again"

- A permanent bar on your benefit

For more on reading your COE, see: VA Entitlement Explained: Basic vs. Bonus Entitlement

Common Scenarios

Scenario A: Small Loss, Lower-Priced Purchase

Situation: $40,000 charged. Wants to buy $325,000 home in standard county. 2+ years since foreclosure. CAIVRS clear.

| Calculation | Result |

|---|---|

| Max entitlement | $208,187 |

| Charged | $40,000 |

| Remaining | $168,187 |

| Max zero-down | $672,748 |

| Purchase price | $325,000 |

| Down payment | $0 |

Result: No down payment needed. No need to repay VA's loss.

Scenario B: Moderate Loss, Higher-Priced Purchase

Situation: $75,000 charged. Wants to buy $600,000 home in standard county. CAIVRS clear.

| Calculation | Result |

|---|---|

| Remaining entitlement | $208,187 − $75,000 = $133,187 |

| Max zero-down | $532,748 |

| Overage | $600,000 − $532,748 = $67,252 |

| Down payment | $16,813 (2.8%) |

Result: Needs ~$17k down. Veteran must decide: make the down payment or repay $75k to restore entitlement.

Scenario C: Large Loss, Limited Options

Situation: $150,000 charged. Wants to buy $500,000 home in standard county. CAIVRS still active.

Result: Cannot proceed until CAIVRS is cleared. Options:

- Repay $150,000 to VA (clears CAIVRS and restores entitlement)

- Wait for CAIVRS to age off (uncertain timeline)

- Use non-VA financing in the meantime

Scenario D: Moving to High-Cost County Helps

Situation: $60,000 charged. Moving to San Diego ($1,104,000 limit). Wants to buy $700,000 home.

| Calculation | Result |

|---|---|

| San Diego max entitlement | $276,000 |

| Charged | $60,000 |

| Remaining | $216,000 |

| Max zero-down | $864,000 |

| Purchase price | $700,000 |

| Down payment | $0 |

Result: The higher county limit provides enough bonus entitlement to cover the purchase despite the charged amount.

Steps to Take After Foreclosure/Short Sale

Immediately After

- Obtain all documentation — keep foreclosure notices, sale records, short sale approval letters

- Note the exact date of foreclosure sale or title transfer

- Request a payoff statement from VA if you want to know the claim amount

During the Waiting Period

- Rebuild credit aggressively — on-time payments on all accounts, keep utilization low

- Save for potential down payment — you may need one depending on charged amount

- Resolve any other CAIVRS issues — especially federal student loans

- Prepare your letter of explanation — document what happened, why, and what's changed

When Ready to Buy Again

- Pull your COE — see exactly what entitlement remains

- Check CAIVRS status — your lender will do this, but you should know beforehand

- Calculate your purchasing power — use the formulas above

- Decide whether to repay VA's loss — based on your purchase goals

- Work with a VA-experienced lender — post-foreclosure files require expertise

Frequently Asked Questions

Q: Does the foreclosure have to be on a VA loan?

A: This post addresses VA loan foreclosures specifically. If you foreclosed on a conventional or FHA loan but never used VA, your VA entitlement is unaffected. However, the foreclosure still impacts your credit and may trigger waiting periods with lenders.

Q: What if the VA didn't pay a claim?

A: If the property sold for enough to cover the loan balance (no deficiency), no claim is paid and no entitlement is charged. You'd still face credit impacts and potential waiting periods, but your entitlement would remain intact.

Q: Can I negotiate with the VA to reduce what I owe?

A: The VA does have a compromise process for debts, but approval isn't guaranteed. Contact the VA Debt Management Center to discuss options. Getting any reduction typically requires demonstrating financial hardship.

Q: How do I find out exactly how much was charged?

A: Request a Certificate of Eligibility through VA.gov, eBenefits, or your lender. The COE shows prior loans, amounts, and entitlement charged. You can also call the VA Regional Loan Center at 1-877-827-3702.

Q: Will the VA come after me for the debt?

A: Yes, the VA can pursue collection on amounts paid due to your default. This may include Treasury offset (intercepting tax refunds) and credit reporting. Proactively contacting the VA Debt Management Center to arrange payment is better than waiting for collection actions.

Q: What if my ex-spouse kept the house and then foreclosed?

A: If your entitlement was used on the original loan, you're still affected. The foreclosure charges your entitlement even if your ex was responsible for the home. This is one of the most frustrating situations veterans face. Your recourse is typically against your ex-spouse, not the VA.

Key Takeaways

- Foreclosure doesn't end your VA benefit — entitlement is charged, not eliminated.

- "Charged" entitlement = the amount VA lost is subtracted from your available entitlement.

- You can still get another VA loan using remaining entitlement (may require down payment).

- Standard waiting period is 2 years — may be reduced to 12 months with strong documentation.

- CAIVRS hits must be cleared before getting another VA loan — repay VA's loss or wait for it to age off.

- Repaying VA's loss restores entitlement — the only way to get charged entitlement back.

- One-time restoration does NOT apply to entitlement lost through foreclosure.

- Higher-cost counties help — more bonus entitlement available despite charged amount.

- Rebuild credit during waiting period — you'll need it for approval.

- Work with a VA-experienced lender — post-foreclosure files are complex.

Sources

- VA Pamphlet 26-7 (Lenders Handbook), Chapters 2, 4, and 6

- 38 U.S.C. § 3702: Basic Entitlement

- 38 C.F.R. § 36.4302: Computation of Guaranties

- VA Debt Management Center: 1-800-827-0648

- VA Regional Loan Center: 1-877-827-3702

- CAIVRS Information: hud.gov/program_offices/housing/sfh/caivrs

Note: Foreclosure and short sale situations are complex and vary significantly based on individual circumstances. This post provides general guidance — consult with a VA-experienced lender and potentially an attorney for your specific situation. Nothing in this post constitutes legal or tax advice.

Underwater with your Florida home with a VA loan?

We've helped hundreds of homeowners short sell and move on with their lives, and we can help you!

Last Updated on January 19, 2026 by Minna Reid