Clay County, Florida foreclosure starts soar!

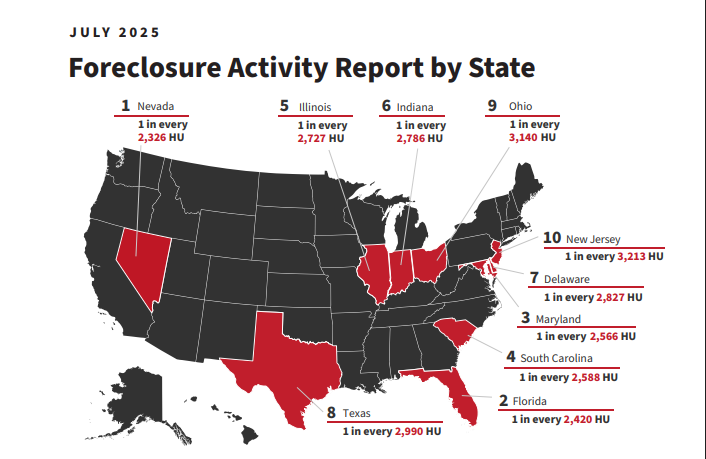

Florida is currently the #2 state for new foreclosure filings in July 2025, with Clay County taking one of the top 3 slots for most foreclosures filed!

Florida is #2 in USA for most foreclosures filed in July 2025!

According to ATTOM Data, 1 in every 2,420 housing units in the state is currently in foreclosure. Leading counties include Bradford, Osceola, and Clay.

Clay County distress home market share is rising fast!

While it takes some time for a home to go through the foreclosure process ( it could take as long as years in Florida), the offer on the market is already visible. For the second year in a row, pre-foreclosures, short sales, and sales of bank owned repossessed homes (REO) are heading up!

What does it mean for your Clay County home sale?

The Clay County market peaked in 2022, and has been cooling down ever since. If you're looking to sell, the buyers have the upper hand as home sale inventory continues to grow and prices head further down, so pricing competitively will be key! If you bought or refinanced at the peak of the market and now need to sell, you may find yourself owing more on your mortgage than your home could sell for at this time. Fortunately, there is a solution to this called a short sale. A short sale allows you to sell your home for less than owed on the mortgage balance, with your lenders approval.

Need help with your Clay County home sale?

Whether you have equity or not, we can with your Florida home sale!

Last Updated on August 18, 2025 by Minna Reid