Florida leads the way in foreclosure starts nationwide with Jacksonville among top 3 cities!

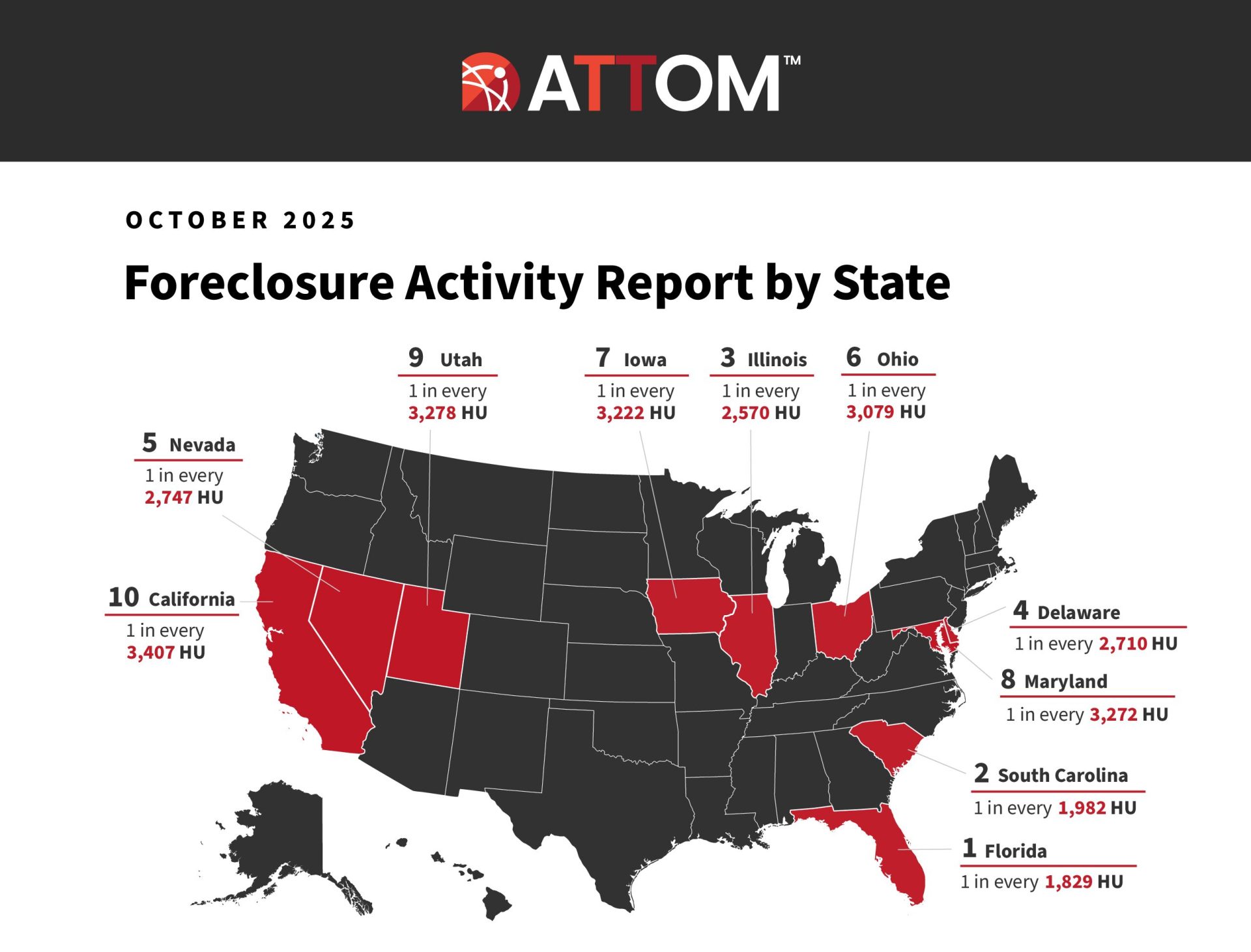

According to Attom Data, as foreclosure rates steadily increase nationwide, Florida takes the #1 spot with 1 in every 1,829 homes currently actively in the foreclosure process.

3 cities round out the top cities in Florida with the most foreclosures with Tampa in the #1 spot, followed by Jacksonville and then Orlando.

Why are foreclosure increasing?

Increasing foreclosures are no surprise as a boom in the housing market 2020-2023 coupled historical lows in mortgage rates with the worst inventory shortage in history. Inevitably home sale prices rose rapidly and significantly as buyers completed for homes. During this same time, government actions suppressed foreclosures from market almost completely, further reducing inventory and aggravating the situation.

What goes up must come down!

Inevitably, the market always self corrects, although in this case it actually took longer than anticipated for the correction to begin. As a Realtor specializing in foreclosure prevention for almost 20 years, I estimate it will take a while and get much worse before the correction completes.

What does it mean for your Florida home sale?

Most homeowners buy and sell as life changes, and are not necessarily trying to time the market. If you are in fact trying to time the market and missed your opportunity to sell at the peak of the market, now would be the time to sell, or prepare to hold for some time, as in my experience market cycles generally last 10 -20 years or so.

If you bought your home during the peak of the market and find yourself now needing to sell, be prepared for your home to sell for less than you paid for it. If you had a limited or zero down payment loan, there is chance you may have negative equity. That means you may have to come to closing with money to be able to sell the home, or if you lack the funds, a short sale may be a solution.

If you've already done mortgage workouts with your lender and are now facing foreclosure, you may be out of workout solutions and must consider a sale of the property.

Most Covid-era mortgage workout options have now expired and there will be limited options for forbearances, loan modifications and partial claims, specifically with FHA loans. Higher interest rates also make modifications more difficult as lower rate loans would have to be rewritten at today's rates, making lowering payments much more difficult.

What if I can't sell for enough to cover my mortgage debts?

Unfortunately, if you've already completed a mortgage workout, you may find that the balance of your mortgage now exceeds your home's value. If you are facing foreclosure or simply need to sell and owe more than your home is worth, a short sale may be a solution.

Owe More Than Your Florida Home Is Worth But Need to Sell?

Fill out this quick form to see if a short sale can help you move on from your over-mortgaged home, debt -free, with no out of pocket costs to you!

Free. Confidential. Your info is always 100% private & secure.

Last Updated on December 6, 2025 by Minna Reid