Jacksonville Florida Real Estate Market Report: 2025 in Review and moving forward!

The Jacksonville Florida Real Estate Market is changing quickly!

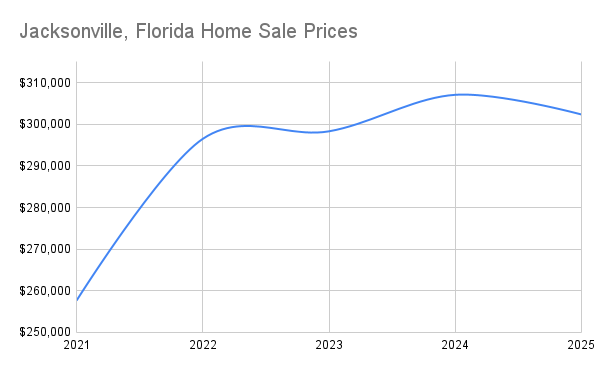

Residential Home Sale Prices are trending down

2025 ended with Jacksonville home sale prices dropping 3% from 2024 to 2025 with the median home sale price for 2025 closing at $302,000. While the market has been slowing down for a few years this is the first significant year over year drop in sale prices.

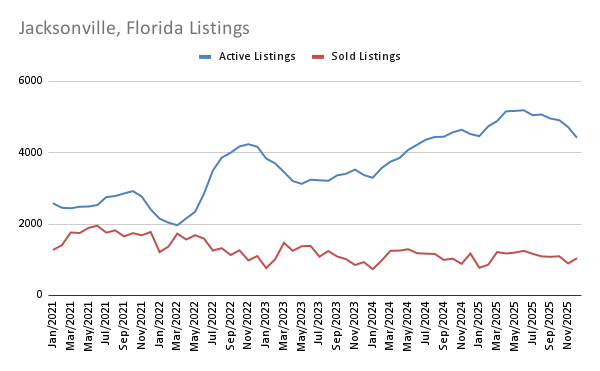

The gap between Jacksonville active and sold listings continues to grow.

While new listing inventory slowed slightly toward the end of the year (as it does seasonally), the overall difference between listed homes and closed homes has continued to trend upwards since the peak of the market in 2022.

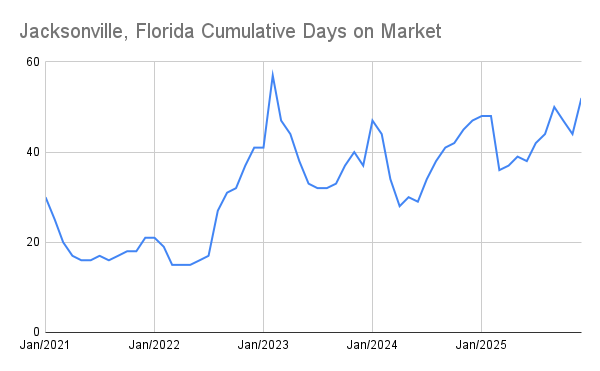

Homes for sale are sitting on the market longer.

As of the close of 2025, CDOM for homes for sale ended at 52 days. Gone are the days of homes selling in a few days in bidding wars. Home selling time has continued to increase since 2022.

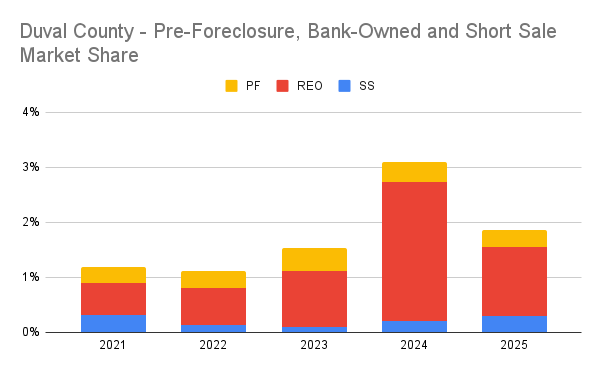

Jacksonville FL REO's are down but short sales are up!

There was large jump in sales of bank owned foreclosed homes in 2024 which actually reduced in 2025, likely due to the backlog of foreclosed inventory finally starting to move through the system after Covid. However in 2025 the rate of short sales increased by ~ 20%. This is due to more folks finding themselves upside down in the mortgage and seeking a short sale to mitigate the situation rather than allowing the lender to foreclose.

What's up ahead for Jacksonville, FL real estate in 2026?

Jacksonville is currently one of the top cities in the country for foreclosure starts, so it's likely the share of distressed inventory (bank-owned foreclosures, pre-foreclosures and short sales will continue to grow. We can expect more short sales as lenders try to mitigate their foreclosure losses through short sale liquidations. Inventory is also continuously rising as is time on market. All of this can only mean one thing for the market: Prices will continue to head down in 2025.

What does this mean for my Jacksonville home sale?

If you can afford your mortgage and plan to stay put for a while, you can see this storm out, however be aware that market cycles can take many years to turn (10-15 or more at times). If you anticipate needing to sell and want to maximize your profits, selling sooner than later would be smart idea.

If you find yourself in the unfortunate position of being underwater on your home, or facing foreclosure and needing to sell - you still have options. Lenders are currently being very agreeable to short sales and loss mitigation departments are not yet overwhelmed, so your odds of a successfully short sale are stronger than ever!

Need help navigating the market changes?

We can help you understand your options, and we've been specializing in short sales since 2007!

Last Updated on January 4, 2026 by Minna Reid