The fall out of FHA's failed Covid-era Loss Mitigation Policies has now arrived.

FHA spent most of the last 5 years aggressively pushing Covid-19 loss mitigation workouts to homeowners. Forbearances, loan modifications, and HUD Partial Claims were handed out liberally, without questions, and with no documentation required proving ability to repay. Furthermore, home-owners could apply for new workouts over and over again, meaning years without mortgage payments were not just possible, but common.

The results are as expected:

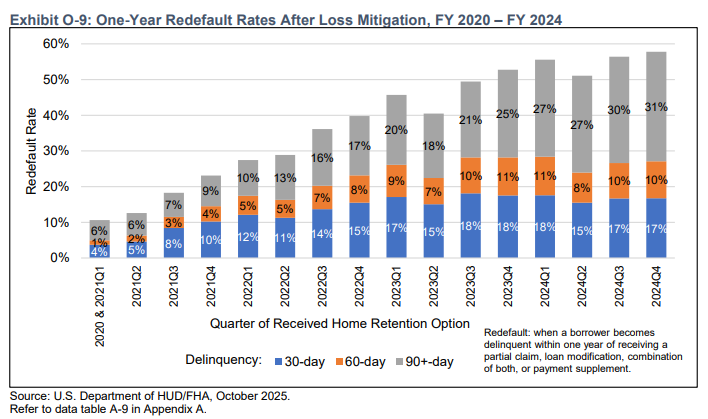

The 2025 FHA Annual Report shows mortgage re-defaults hovering near 60%.

In a surprise to no one, offering home owners repeated, no-questions-asked, loss mitigation workouts, does not lead to long term successful mortgage repayment. It only leads to re-defaults.

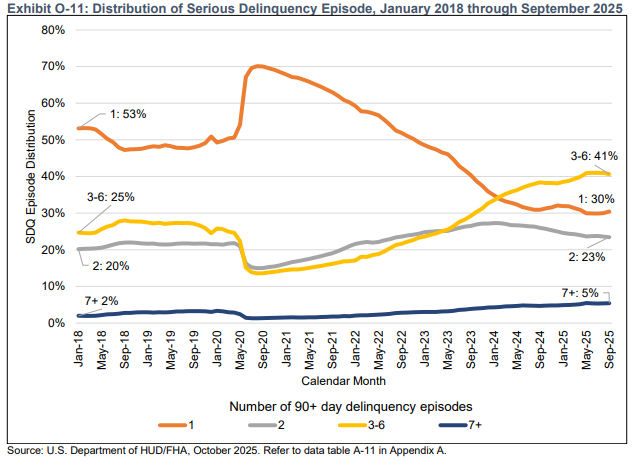

As of September 2025, the plurality of Borrowers (41 percent) were delinquent 3-6 times.

Per FHA, this indicates that borrowers are continuing to experience persistent issues without long-term success. Consistent with the redefault and serious delinquency data, borrowers are receiving home retention options to attempt to cure their serious delinquency with greater regularity.

Almost 70% of FHA Borrowers have had a loan workout in the past 5 years.

In January 2018, 30% of borrowers had one or more prior home retention options in the prior five years and nearly 2% had two or more. By September 2025, that increased to 66% and nearly 40%, respectively. This means 40% of borrowers who received a partial claim or loan modification in September 2025 were getting their third option in five years.

While many FHA Borrowers were able to remain in their homes with no or few payments over the past 5 years, the long term financial success of this approach has, unsurprisingly, proved a failure.

Key Policy Reforms Under the Trump Administration to FHA Loss Mitigation on April 15, 2025:

- Ended FHA’s COVID-19 Loss Mitigation Options, effective September 30, 2025.

- Advanced the effective date of the new permanent loss mitigation options to October 1,2025; instead of the February 2, 2026 date announced by the previous administration.

- Ended FHA-HAMP, effective September 30, 2025.

- Extended the time on the eligibility of a borrower for a subsequent permanent loss mitigation option to once every 24 months, from once every 18 months as announced by the previous administration.

- Cancelled the previous administration’s scheduled increases in borrower compensation under FHA’s Pre-foreclosure Sale Program, Deed-in-Lieu of Foreclosure disposition options, and Cash for Keys incentives, maintaining the existing amounts.

FREE SHORT SALE SURVIVAL GUIDE!

A STEP BY STEP MANUAL FOR GETTING THROUGH THE SHORT SALE PROCESS!

While FHA loss mitigation policy has been reformed, there is now a massive backlog of defaulted and now due FHA loans to be accounted for.

According to ICE Techonology Mortgage Monitor:

- Foreclosure activity trending upward: December’s 40,000 foreclosure starts marks the third highest monthly volume in 2025, up 28% from the year before. Foreclosure inventory is up by 47,000 (+25%) year over year, and foreclosure sales have increased by 2,100 (+41%) from last year's levels.

- Government loans driving foreclosure growth: While foreclosure activity remains muted by historical standards, the number of loans in active foreclosure again hit its highest level since early 2023, driven by a notable rise in FHA foreclosures (+59% YoY) along with a resumption of VA activity following last year's moratorium.

What happens to FHA Borrowers in default who can no longer get another workout program?

These home owners will either have to correct their default, liquidate their property, or face foreclosure. Since the majority of home owners who opted in to loan modifications and partial claims are now without the equity to sell traditionally, many will be seeking a short sale to move on from their situation. Short sales allow homeowners to sell for less than their mortgage balance. Luckily, FHA also offers a short sale program, known as the FHA PFS Program.

Owe More On Your FHA Loan Than Your Florida Home Is Worth?

Fill out this quick form to see if a short sale can help you move on - free, confidential, and stress-free. We’ll guide you step by step!

Free. Confidential. No out of pocket costs. Your info is always 100% private & secure.

Last Updated on January 29, 2026 by Minna Reid